Tax Increment Financing (TIF) is an economic development mechanism available to local governments in Ohio to finance public infrastructure improvements and, in certain circumstances, residential rehabilitation.

How does TIF work?

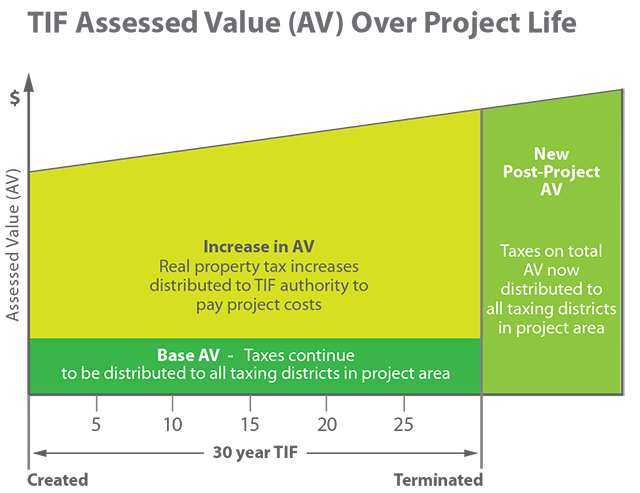

Qualified TIF projects dedicate a portion of the incremental property tax payments, derived from the increased property value of the project, to finance bonds issued to pay for certain public infrastructure costs related to the project. This program can provide 100% fixed-rate, tax-exempt financing for 10 to 33 years. TIFs are implemented at the local level and may be created by a township, municipality or county.

When is TIF used?

A TIF is used to address site and infrastructure development obstacles for a project. The TIF Program assists developers, municipalities and others in financing public infrastructure projects such as roads, curbs, streetlights, utilities, sidewalks, landscaping, public parking garages, etc. Developers, Business Owners, Non-Profit Organizations and Governmental Entities may qualify for this.

What are the advantages of TIF?

Payments derived from the increased assessed value of any improvement to real property beyond that amount are directed towards a separate fund to finance the construction of public infrastructure defined within the TIF legislation.

Tax Increment Financing:

- Can be a powerful tool to help finance projects

- Does not divert funds from an existing budget

- Use can overcome site problems or costs

- Correct use can generate new investment, employment, and tax revenues

How to Establish a TIF

Local jurisdictions seeking to establish a TIF project must enact legislation that:

(A) designates the parcel(s) to be exempted from taxation

(B) declares improvements to a private property within the specific area as serving a public purpose

(C) delineates the public infrastructure improvements to be made that will directly benefit the parcel

(D) specifies the equivalent funds to be created for those redirected monies. Only those public infrastructure improvements directly serving the increased demand arising from the real property improvements to the parcel

If you are interested, or want to learn more about TIF, contact:

Tiffany McClelland: tmcclelland@lorainportauthority.com

[Note—City approval is required for all TIFs. In addition, consent of local school board is required if the pledged TIF revenues exceed 75% and if the term is more than 10 years.]